Lighthouse #21

Curating the best insurance, insurtech, innovation and leadership content for you.

Ron Arnold

11eight | Linkedin | twitter

When the winds of change blow, some people build walls and others build windmills.

Chinese proverb

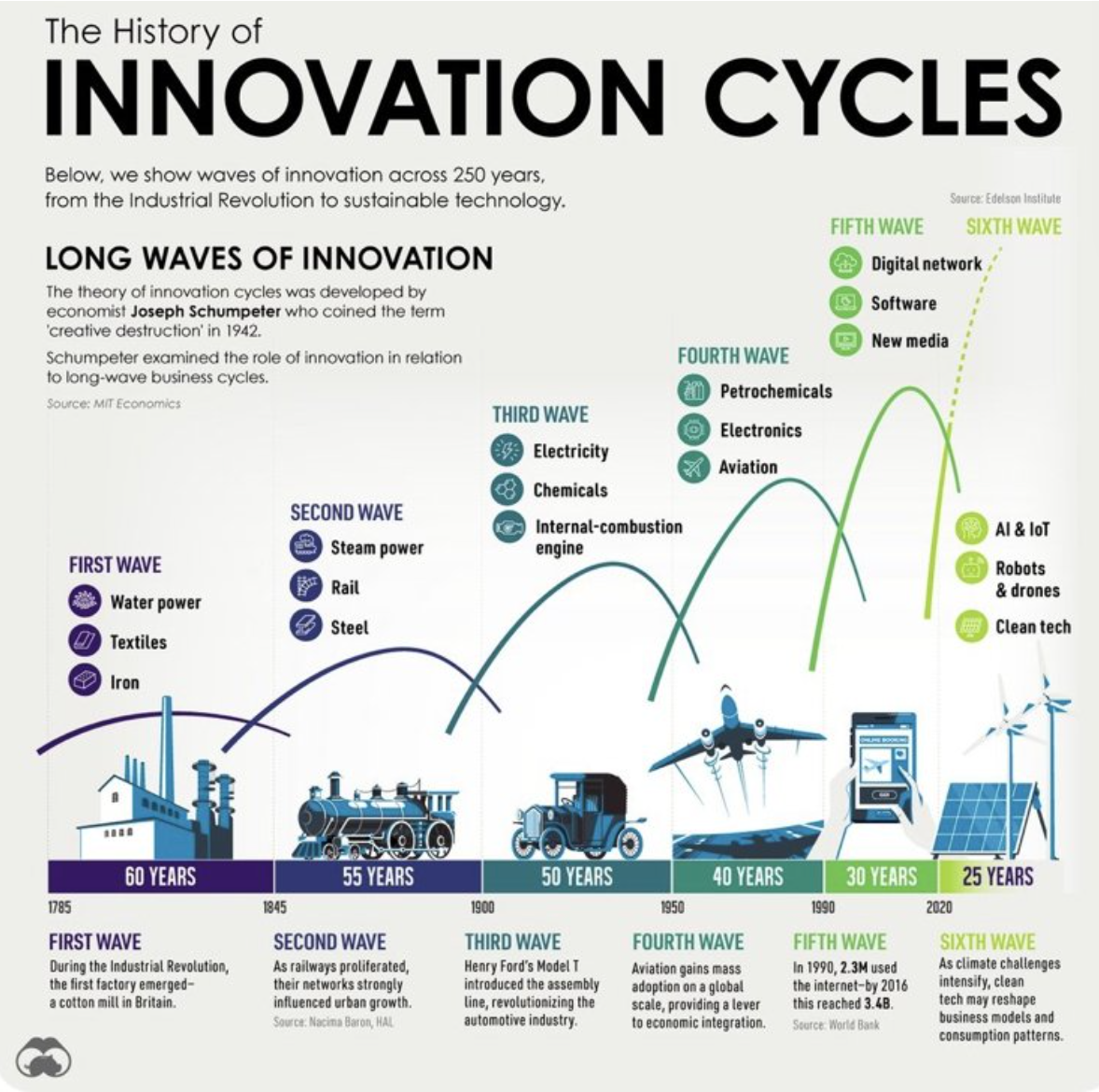

“When Will It Happen?”: In my many years leading strategy in some big corporates, this was one of the most common questions asked by Execs and Boards when the discussion involved disruptive threats, opportunities and “new futures”. It is also a question the 11eight team often gets from Boards and Exec teams we work with. All too often, there is a tendancy to think the disruption wave - new capabilities, business models and propositions will hit quickly. This is rare, it often takes years and sometimes decades. And sometimes, when it can’t be seen “now” it is dismissed by Exec teams altogether. However, the ripples of disruption can be seen a long way out - if you are open to looking! In insurance, we are seeing those now in everything from climate change, to IoT, embedded, AI, open data, cyber, new mobility models and bigtech. I found the attached diagram helpful as it highlights disruptive wave time frames and is a useful reference to highlight that change takes time.

Top 3 Insurance Jokes of All Time: OK, so I asked ChatGPT for the best 3 insurance jokes ever.

”Here are three classic insurance jokes that are widely regarded as some of the best:

Why did the insurance company hire a paranoid person?

Because they wanted someone who would always be on the lookout for risks!Why did the actuary refuse to jump out of an airplane?

Because the statistics didn't support it!Why did the insurance adjuster refuse to pay for the broken mirror?

Because it was a clear case of reflection negligence!”

Comedians are safe for a while….but maybe Christmas Cracker joke writers are not?

Consumers Are Prepared to Buy Insurance From Bigtech: Mention bigtech, and suggest it should be considered a serious future competitor set, and many insurance Execs will be dismissive.

A recent Guidewire Software Survey, covering 1000 18-55 year old UK consumers, reports:

30% see Amazon as a trusted brand and see no reason not to use it for insurance

30% would probably use it and hope it will make buying insurance easier

Almost 40% of people would, the next time the buy insurance from the likes of Ikea, Tesla or Amazon (eg car, bike, furniture) be comfortable with buying insurance from the company they bought the product from.

These insights come on the tail of the recently announced Zurich partnerhsip with Sky to sell home insurance.

Evidently, the opportunity to embed an insurance offer in the product purchase flow is very real. Of course, whether these bigtech players have the energy, focus, appetite and patience to really make a go of insurance is a different question. Nevertheless, I remain of the view that mainstream insurers must be monitoring bigtech’s insurance moves. They may become a serious competitor! And if you care to have a look they are exploring quite a few things in the insurance domain.

For mine, at least in the first instance, I reckon bigtech entry is a distribution play. Insurance is messy...and hard. I don' think bigtech has the patience to work it out or the appetite to expose their balance sheet to insurance type risk. They are good at UX though, and have enormous reach through their platforms. As a distribution play they will need to partner with insurers who can go on the journey with them. Interestingly, this could be through exclusive arrangements or through aggregation type plays. Either way, it will be challenging for insurers if bigtech has a real go at it! Source: Guidewire

Another Telematics Launch - But Not in Australia or NZ: We continue to see new telematics offerings hitting the market - not in Australia or NZ but elsewhere. Vienna Insurance Group is introducing Koopilot. Koopilot is new telematics app that gives policyholders the option to earn cashback for save driving. Every three months, the app will provide a driving score and calculate a cashback that can range from 10% to 40%. The app features an emergency button that enables a user to initiate a call requesting assistance. The user then gets an immediate call back - which can include emergency services dispatch to the accident. What is stopping the roll out of telematics in Australia and New Zealand? Source: Coverger

Telematics Saving Lives: Reduce distracted driving, reduce accidents, save lives and prevent injury….Something all insurers should be interested in. Not to mention the opportunity to improve risk selection and pricing and improve profitabilty. A RACWA and Sentiance case studies shows mobile phone distraction decreased significantly for users of the Safer Driver app:

50% of app users who received coaching reduced their distraction by almost 60%.

75% of app users engaged with the focused-driving challenges.

Source: Sentiance

CMT Launches Drivewell Crash and Claims: Really interesting product recently launched by Cambridge Mobile Telematics - DriveWell Crash & Claims. The telematics solution for auto insurance claims. The CMT’s AI-driven DriveWell® platform can detect car crashes from sensor data allowing auto insurers to proactively help customers with emergency and tow services within seconds of a crash. Learning about a crash as soon as it happens also enables insurers to use in-network providers, reducing the cost of each claim.

Real-time services like crash assistance are popular with consumers, with CMT reporting Net Promoter Scores of over 80. DriveWell Crash & Claims features not only real-time crash detection and assistance, but also total loss, injury, and fraud detection capabilities.

No doubt in my mind, this type of solution is a critical development and capability all auto insurers will need and should have. Others also offer solutions in this space. Chris Hulls and the Life360 team have a very successful offering in this space and it is noteworthy that “crash detection” is a feature of a recent Apple launch.

Source: Business Wire

IAG’s bots saved 700,000 work hours: Quite a few interesting stats in this article about IAG:

IAG has deployed 145 bots which it claims have so far saved the company about 700,000 work hours.

The bots are applied to highly repeatable tasks that were previously handled manually by humans, cutting out 150,000 hours a year.

During the recent floods in New Zealand bots were used to share reports for field assessors across platforms, eliminating manual activity and updating 8000 customer records in three days.

The platform upgrade has increased the number of claims lodged through digital channels, with 69 per cent of claims lodged online following recent weather events, leading to faster processing times.

The information on claims is interesting as I recall many discussions whilst in corporate where there was a view that "people will never lodge claims on-line - they will always want to speak to someone". A very similar line of argument to "people will never buy policies on line - they will always want to speak to someone on the phone or in a branch". The migration to digital servicing is continuing - as the UX improves and customers become more familiar and comfortable. And both the Suncorp Group and IAG, to name just two, have some fairly clear intentions to invest in and leverage digital channels. And one would expect that AI applications, and the use of new data sources, will become increasingly important also. Source: AFR

QBE Ventures Invests in YellowBird: The team at QBE Ventures is investing in YellowBird.YellowBird is Safety and Risk Management technology. YellowBird, a certified Disability-Owned Business Enterprise founded in 2022, has created a marketplace for safety, risk assessment and remediation services. Risk mitigation is a growing area of interest for insurers, so this makes sense, particularly in the OH&S space - which historically can be a volatile portfolio. It is not too much of a stretch to assume that a business that manages its risks "pro-actively" is likely to be good insurance risk. Source: QBE

A Picture Paints 1000 Words: IAG has invested in Tel Aviv-based RAVIN.AI AI. Ravin uses AI to inspect the condition of vehicles using mobile phones and standard CCTV cameras. The technology was built from scans of over two billion vehicle images and is used by insurers, auto and rental firms in the US and Europe, including Toyota. Ravin AI, which also has offices in London and Texas, was founded in 2018 by Mr Ekstein and Roman Sandler and has raised $US30 million ($44.14 million) from investors, including FM Capital and Shell Ventures. Another image based insurtech investment by Firemark Ventures. Two others being DAS (Digital Agriculture Services) and Arturo. Is there a picture emerging here? Source: Insurance News

Personal Cyber Insurance: Hardly a day goes by when we don't hear stories of the latest consumer cyber scam, or we don't get a dodgy phone call, text message or email...I don't think there have been too many insurance products introduced in Australia or New Zealand for consumers? But we are seeing some products being introduced overseas. A couple of examples:

FWD Insurance Singapore has announced that it has strengthened its home insurance coverage with complimentary cyber fraud protection. Customers who purchased or renewed their home insurance policy will receive this free cyber insurance designed to safeguard against the financial impact of cyber fraud. This cyber coverage is available for 12 months, covering online shopping fraud and fraudulent electronic transfers. Both instances are covered with up to $5,000 for financial loss. The cyber insurance covers the person, not the device, so customers are protected regardless of what devices they use. Source: Insurance Business

Surance.io has partnered with IDI Direct Insurance to create a personal cyber Insurance policy and an App called “Cyber Up”, which launched in cooperation with GDH TLV. It is reported this multi-layered cyber protection offers personal cyber insurance to individuals as well as families. The product provides risk prevention tools that help consumers protect themselves and their electronic devices against cyber-attacks. It also provides them with compensation and 24/7 support in case of a cyber-attack and advanced smart home risk mitigation service. Source: Israel Tech News

11eight is a specialist consulting firm helping Corporates get better results from their innovation and helping start-ups get ready to work with Corporates. While 11eight takes due care with the information contained or implied in this Newsletter, 11eight does not warrant or guarantee its accuracy. Readers should validate the information and 11eight accepts NO responsibility or liability for any actions readers take based on information contained herein. Please sign up to our Newsletter and you can contact us here.