Insurtech | KOBA | Andrew Wong

Andrew Wong grew up in Los Angeles, and it’s because of the LA scene that he believes he wanted to be an actor. He says that he continues to grow by drawing inspiration from people who “have been on top of the mountain”, as he puts it. He says there is always great learning in their war stories, experiences and failures and thinks if you are genuinely interested, people are happy to share. Andrew has over 10 different mentors that he works with on a regular basis; each of them are strong in different areas and help push him to be better.

Andrew has founded a new business called KOBA which focuses on giving affordable car insurance based on how many kilometres you drive. His goal is redefine car insurance and make it easier for everyone.

We were lucky enough to talk to Andrew and find out all about KOBA and a bit about Andrew’s journey.

KOBA Founder, Andrew Wong

What gave you the idea for KOBA? How did KOBA start?

2020 was obviously a tough year for everyone. And like many, my wife and I were looking for ways we could save money…every little bit helps in uncertain times, right? After being in lockdown for a month, we realised where we could make changes and where we were ‘stuck’ with the same costs; car insurance being one of them. We had to continue paying the same rates, regardless of if we were using our car. Did you know in 2020, Australian car insurers pulled in an incremental $800M in profit vs. 2019? So many people needed cash to survive during the pandemic and insurance companies were raking in the benefits of people not driving and having accidents!

Any key stats, data, reports, research you can provide to give flavor to the opportunity/problem?

In every facet of our lives, we’re connected. Smart phones, smart watches, smart picture frames, smart doorbells, smart homes… even smart fridges. All of which are creating huge disruption in their respective markets. The next wave? Connected cars. Australia is all in on the connected car future.

It’s forecast that over 90% of all new car sales by 2030 will be pre-connected to the internet. All the car manufacturers have huge connected car divisions looking to create future personalised experiences and services for their consumers.

KOBA Insurance is tapping into this. Let’s join the connected car revolution, shake up an archaic industry and set new customer expectations.

What does KOBA do? Who is the solution for? What problem does it solve?

KOBA is modernising Insurance. We figured, if car’s are getting smarter, we should make inusrance smarter too.

Beating the price of competitors. Unlike traditional car insurance models, KOBA works on a pay-per-kilometre model. Low-usage drivers can cut their insurance premiums, we have customers saving up to 50% off their previous bills. KOBA will only charge you for what you use.

Redefining ‘Great Service’. Traditional insurers offer “great service”; some even say that “you’re lucky to be with them”. This always refers to the claims process; <provider> “we’ll help you get back on the road quickly and cover your losses after an accident”. We don’t think that’s good enough. To us, that’s literally the product definition of car insurance. Pay a small premium now, so if a large payment is required after an accident, you’re covered. Covering your losses after an accident is just doing your job.

At KOBA we want to make the claims process easy, smooth, and simple. We put all the information you need in an app. Having a good claims service is table stakes. About 12% of customers get in an accident every year. This means that 88% of customers get no value for their insurance each year. Through the data connection to the car, KOBA is building a proactive service that covers drivers, as well as helps them everyday. In the next year, we will go-to-market with service offers such as:

Find my car

Crash detection

Severe accident detection - Auto call ‘000’

Digital car mechanic

Carbon emissions tracker

Driving behaviour reports

Roadside assistance

What is your elevator pitch?

KOBA is a usage-based car insurance company for personal vehicles. Your rate is based on how much you’re actually driving each month. If you’re driving less, you’ll pay less. Simple.

Traditional insurance models are built from aggregated data sets and averages of the population. Some insurers do a better job than others to personalise the offer and dig into granularity of the data, but ALL of these programs are still created on forecasts and models. Connected car data allows KOBA to take actual driving behaviour and the distance you travel to charge you a rate just for you. For the first time in Australia, you determine your premium, not us.

What is unique about KOBA?

Everything - the product, the service and our passion. We are creating a new, redefining category in car insurance; a true service for everything car related. The way we believe car insurance should have always been offered.

I know that everyone says that their team is the best, but in our case it is. Our advisor panel has 3 C-level car insurance executives, each who have run portfolio’s over $1Bn and in various countries around the world. Our operational team has worked in multiple start-ups and have led teams across Australian car insurance scale-ups and enterprise offers.

What have you learnt about raising capital?

Be clear on your value (not valuation). If you're pre revenue or in the first year of sales... there’s no way to understand what your growth potential is. Let's be clear... your current business valuation based on actual revenue is $0... but your future value could be huge. Don't let investors bully you. If they start talking about valuations then they're using the wrong metrics to measure your success or potential, it's too early to understand how big you can become

Know what size check you are looking for. And in the first 5 minutes of talking to investor ask them how big their average check is and how many investments of that size they have made in the last 12 months. If the answer is less than 3, then walk, they will waste your time

Don't try and convince an investor to invest. They all have their own thesis and (for the most part) they are smart people. They either get it or they don't. They are investing in you not your idea.

There's only 3 things that are important to an investor: team, traction, and size of the market.

There are plenty of fish in the sea. There is plenty of capital in Australia, tons of great ideas, but only a hand full of success stories. Investors need you, more than you need them

Raise at the right time, not because you need money. You have to have some traction. If you don't have traction, then raise from FFF. If your friends won't give you money... why should strangers?

What do you think Corporates can learn from early stage businesses?

Corporate businesses know how to scale businesses, they know how to shift major markets and win hearts and minds. But corporates are slow. Most go through 3-5 year innovation cycles.

The product and service markets are going through a revolution. Customers are no longer limited by physical retail, or geographical boundaries. Consumers now have the opportunity to purchase products from anywhere, anytime. So brands that are winning nowadays, are investing in culture, community and experience. This is where start-ups excel, and Corporates need to follow the way start-ups invest in people and processes first, over profits.

Where do Corporates need to improve in working with/supporting early stage businesses?

Any good manager always works to build their team to make themselves redundant. Corporates should look at start-ups the same way. By actively looking to support growth in start-ups, Corporates can be part of the disruption and change rather than being left out. If the disruption is truly successful, it is the Corporates role to help the start-up exit and then scale the solution across other markets.

Looking back, with what you know now, what would you have done differently?

Everything and nothing. It’s taken me a long time to get here. I’ve had 3 prior start-ups, all of which failed. I’ve blown up my professional career 2 times and I’ve pretty much done everything you’re not supposed to do…and I wouldn’t trade any of it. It’s made me battle hardened, given me confidence that I can produce and burst every unrealistic ‘get rich easy’ business dream I've ever had. To me, the only way to success is hard work, a tonne of luck and surrounding yourself with great people.

Where do see KOBA in ten years?

I don’t know where KOBA will be in 10 years. This will be dictated by Australia drivers. But I know where I will be. Still here, still driving change, still dreaming, still pushing and still trying to be the best version of myself I can be.

Biggest challenge you have faced so far?

I don’t know if any challenge has been too big or hard to overcome. I’ve been lucky enough to have a very supportive family. We’ve moved all over the world chasing corporate and start-up dreams. For that, I am thankful.

The biggest challenge has probably been my own personal development. I’ve always been confident and sure in my abilities, so I’ve had to learn how to ask for help and how to listen. In the same breath, I’ve had to learn how to quickly prequalify advice and discount opinions. In the start-up world, everyone has an opinion and everyone knows someone, who knows someone, who has been super successful. There are very few people who have succeeded in this game and have had a hand in shaping an industry. If you can find those people, hold on for dear life.

What are the key disruptive forces you see facing the insurance industry?

It’s distribution and commissions. There are 2 ways to buy most products, through a broker or direct. Brokers get paid great commissions and it’s hard to break them from this drug; the reality is that most products are similar, so the broker advises the product with the best commission. Going direct is hard too. It takes a lot of time, money, or some serious social media skills; especially when all incumbent insurers can outspend you.

So how does a new entrant win? We build value and community. We start small, change the paradigm, and offer real value.

What is your focus now? And for the next couple of years?

We’ve been live nationwide since March and we are growing 50% month on month. The cost of living is going up right now and KOBA is a great way to save money. Over the next few months we need to bed down our operational flows and ensure we can deliver on our customer value propositions. And then in the new year, it’s go time. We’ll be pushing out new growth campaigns, new product features, and new insurance products. We can’t wait!

What are the one or two lessons/principles/ you carry with you into everything you do?

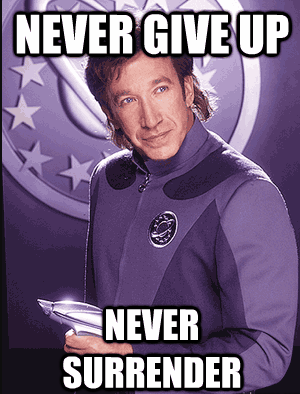

In 1999, there was a cult space movie called Galaxy Quest, it starred Alan Rickman and Tim Allen. I love this poster.

These are the rules I live by.

How do you balance your personal time and your ‘work’ time?

I love my work, so finding balance isn’t really a goal for me. Since having kids though, I’ve wanted to make a conscious focus to spend quality time with them, so I have some rules/goals:

Eat breakfast and dinner together 5 days a week

Always have the next holiday booked before we go away. That way when we come home, we already have the next family event to look forward to.